Digital Switchover

Péter Vári

Digital switchover does not seem to be an easy task. The digitalization of television and radio broadcasting is a complicated process with far-reaching economic and social consequences, equally affecting inhabitants, services and governmental sectors, because:

•it targets all households,

•it expands audio-visual service selection,

•it may promote the use of information society services

•it creates a significant need for service provider (transmitters, network) and consumer (decoders, digital receivers) investments

•it may result in rearrangement of analogue market positions and revenue processes in the communications and media sector

•it speeds up institutional and regulatory convergence processes.

The basic task is the switch-off of analogue terrestrial television broadcasting. From the state’s point of view, the viewers of analogue terrestrial television networks will necessarily have to give up this reception mode. The frequency owner is the state, therefore the state has a very important role during this process. The past period has given newer tasks to the state, such as mobile television broadcasting. There are various technologies that can be used to provide mobile television service to the subscribers. The main question is which technology will be supported or accepted by a particular country. As for the European Union countries, the common market required a uniform solution based on harmonized frequencies and DVB-H was as a winner technology.

Another new task is the digital dividend. The European Union stimulates the authorities and the market players into more efficient use of the frequency spectrum, meaning that the frequencies originating from the digital switchover should opened up for new services in the future. This affects the frequencies above the channel 61 in the UHF band.

It is not easy to meet both the external and internal requirements set by the state. The main internal requirements derive from international obligations set by the ITU and the EU or from the coordination with the neighboring countries. The external requirements come from the fact that the state is the frequency owner, while, at the same time, it controls the affected markets by means of authority and partcipates in the market through public broadcasters.

The countries encounter similar problems and questions, but solutions will be different. This promts the question of whether it is necessary to make a strategy before the switchover, and if yes, what kind of strategy? Should it insist on terrestrial broadcasting or allow for technical neutrality? The problem regarding the digital switchover is complex because it concerns two fields: the electronic communications and audiovisual market. It is more than a communication task or a technology change, the viewers want more content and better quality compared with the former analogue era. People do not want to buy boxes, they want audiovisual experiences.

It is very important to get to know and analyze the market of analogue television in the given country. Depending on the result of the analysis, the state can define its position. In countries where the analogue terrestrial television platform is very strong, the state has an easy task in finding the solution(nationwide campaign or a subsidy system, for example). The countries which belong to this group are: Italy, Spain and France. Also, in the countries where the analogue terrestrial reception mode is negligible, the task of finding the solution is easier for the state (few affected people, “personal” campaigns and subsidy). Countries which belong to this other group are: Belgium, Netherlands, Switzerland.

In the countries where the terrestrial reception mode is considerable, but the public broadcasters, i.e. the state, do not have the major market share, the task is more difficult. The strategy envisaging the withdrawal of the market players, may provide a solution in this case. If the state does not wish to undertake a greater role, the market players shape the market in an organic way except in case of the terrestrial platform. The cable television operators launch digital services at a saunter, while the Direct to Home (DTH) satellite operators rapidly gain ground. The switchover process is based on market drive, except in case of the terrestrial platform. The aim of the strategy is to define the desirable development in these markets.

Frequency is a scarce resource as we know, but the value of the frequency depends on the circumstances. Based on the aforesaid process, the cable television and DTH service providers increase their market share, and the value of the frequency for terrestrial broadcasting becomes smaller year by year. The later the states launch digitalization, the lower the value of the frequencies will be for them. The social usefulness of the terrestrial digitalization is questionable in view of the loss of state assets.

I believe that it is necessary to create a national strategy for the digital switchover in which the state works together with the market players. The Strategy has to be transparent for all market players. The first step after the market analysis is to determine what could be the main priorities of the Strategy? The priority could be strengthening of the media pluralism or efficient management of limited resources. The second step is to define the specific objectives for each priority. The third step is to create the indicators for each objective. The indicators could be the percentage of DTTV households or the number of MPEG 4 STB’s. Adequate instruments will help us achieve the objectives. The main categories of the instruments are public policy, regulatory tools and forms of subsidy. The number of priorities, objectives and indicators depends only on the authors of the Strategy, whereby it should be kept in mind that “He who grasps much, holds little.”

Having answered the basic questions, the Strategy needs to give an answer to the following questions as well. Which method will help us achieve our goals: with or without the application to operate the DTT network?)? What will the object of application be: multiplex, transmission or both? How many multiplexes will there be in the tender(s)? Is the objective to have competition in the particular platform? Will there be real competition? Which model fits the Strategy best (strong multiplex, week multiplex or mixed)? Should a specific business model be defined? Should legislation be modified or not? Finally, the Strategy needs to define timetable in terms of deadline and rules for the ASO.

After finding the best and suitable solution, the DTTV service can be launched. The state has very important tasks, prior to the ASO of course. The state and regulators must work together with the market players and control the process for the success of the digital switchover. Furthermore, while the operator is building the digital network, analogue terrestrial broadcasting should remain at the same quality level, for as long as possible during the simulcast.

The next chapters present two countries, two solutions and possible answers to the above questions, along with their background.

2. HUNGARY - MARCH 2009

2.1. Policy and regulatory aspects

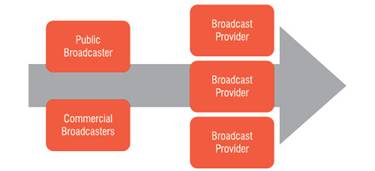

The Prime Minister’s Office prepared the Digital Switchover Strategy, which was accepted by the Government decision in March 2007. The Strategy reviews all market segments, including the terrestrial, cable, satellite, IPTV and other solutions, and covers both radio and television markets. The Strategy basically deals with communications, but it also predicts that the success of the digital switchover without a new media concept is impossible. What is interesting is that the value chain was made on the basis of the Strategy (Program provision – Broadcasting – End user).

The main points and statements: It is necessary to switch off the analogue terrestrial TV broadcast network till 2012, and digital television service will be available for everybody. The platform is technologically neutral.

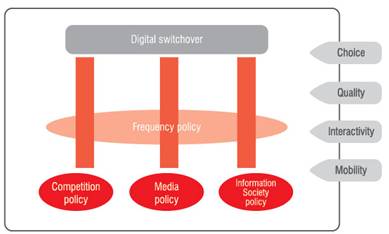

Figure 1. Policies

Source: Prime Minister’s Office website

The most prominent EU initiative regarding digital switchover concerns the Commission’s wish to coordinate the switch-off of analogue terrestrial television broadcasting at the community level, in order to validate community level spectrum management aspects: the latest date on which member states are allowed to switch off analogue broadcasting services is December 31, 2011. Considering the fact that majority of the neighboring countries intend to adhere to this deadline, adopting a later target date would give rise to diplomatic difficulties for Hungary from the frequency coordination point of view, as surrounding countries would be unable to fulfill their objectives without Hungary’s switching off analogue terrestrial services.

As a result of the RRC-06 meeting, the set of frequencies necessary for launching digital transmission will only be available after digital switchover has been fully accomplished (after 2012). Until this is achieved, the frequencies negotiated with the neighboring countries currently offer three terrestrial digital television networks in the switchover period until 2012.

2.1.1.Licensing /authorization schemes

The Strategy and the law define the rules for the implementation and operation of the digital television network. Basically, the tender was a beauty contest, but the tender documentation set out some rules on the way in which the digital switchover should be carried out by the winner. The main goals and rules were as follows:

- The following market players were not allowed to apply: main cable TV or DTH operators who have more than 300,000 subscribers, and commercial and public broadcasters.

- If the present analogue broadcaster provider applied for this position they had to establish a new company.

- Five of eight multiplexes were open to tender (because the legislators considered the digital dividend).

- The tender intended to encourage the applicants to choose state-of-the-art technology (MPEG-4 for example) with extra points in the tender process.

- It also inspired the applicants to operate DVB-H service on one of the five multiplexes from the beginning (the frequencies on the second multiplex are suitable for DVB-H service).

- Extra points were awarded if the applicant guaranteed that new commercial broadcasters would be available on the first multiplex.

- The present commercial broadcaster using the nationwide analogue terrestrial network was entitled to join digital broadcasting provided they accepted that their analogue license be terminated before the deadline (2012). They could choose between two options: they could keep their analogue license and not be available on the digital multiplexes, or they give up their analogue license before the deadline and have the right to use the digital multiplex without any tendering.

- The public broadcasters are under the rules of must carry. They have a basic right to be on the multiplex without any tendering.

- The authority defined the minimum criteria for coverage and roll out. The applicants could offer quicker implementation and higher coverage.

- Extra points were also provided for interactive services and campaigns. The campaigns included provision of the designated webpage, distribution of leaflets and advertisement.

- The criteria were that the winner should operate a helpdesk and showroom.

- The winner should subsidize the set top boxes for those with a low standard of living.

These criteria provided grounds for strengthening the competition in the electronic communications and audiovisual media.

2.1.2. Applicable standards

DTTV is based on DVB-T and Mobile TV is based on DVB-H standards.

The MPEG-4 (AVC/H.264) Audio Musicam and/or Dolby Digital Plus (E-AC3) standard was offered by the winner and the service based on it was launched in December 2008.

2.1.3. Broadcasting network structure (multiplex ownership, transmission network)

The present analogue situation:

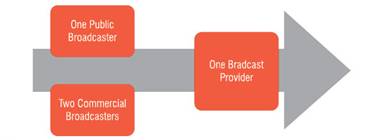

Figure 2. Analogue network structure

The present digital situation:

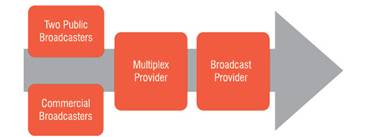

Figure 3. Digital network structure

A former analogue broadcast provider won the right to operate five digital multiplexes (A,B,C,D,E), and this company (Antenna Hungária Zrt.) established a new company in compliance with the rules. The new company is 100 % owned by Antenna Hungária Zrt. The real service provider is Antenna Hungária Zrt, but it is easier for the authorities to monitor this market field (two companies means separate accounting for the analogue and digital license).

The multiplex provider is based on a strong multiplex model, in the same way as cable television or DTH service providers. The multiplexes operator could define the content which will be available for the viewers (with the obligation of broadcasting the public broadcaster the multiplex, as well as two commercial broadcasters with the right to be on the multiplex, as stipulated by legislation). The multiplex service provider (who is the broadcast provider in Hungary ) has the opportunity to choose attractive contents for the multiplexes, which could be FTA or Pay TV channels. On the other hand, the opportunity means responsibility. It is necessary for the multiplex provider to find the best business model, which means they have to analyze the audiovisual media and electronic communications field as they have strong competitors (cable TV and DTH providers).

Table 1. Broadcasters

| Name of broadcasters | Coverage | Type | Channels (Terrestrial) | Remarks | Coverage Population % |

| MTV | Nationwide | Public | M1 M2 (satellite) | M1 (part time regional) | 97 % |

| M-RTL | Nationwide | Commercial | RTL | | 86 % |

| MTM-SBS | Nationwide | Commercial | TV2 | | 86 % |

License expiry date for analogue commercial broadcasters is June 2012.

2.1.4. Strategies and process of transition to DTTV

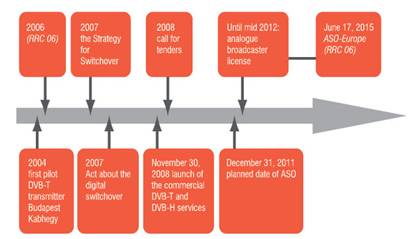

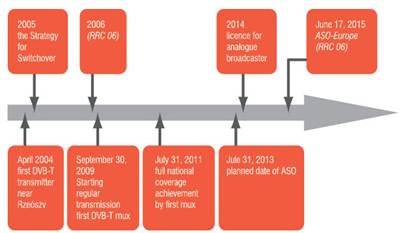

Timeline for introduction of DVB-T is shown in Figure 4.

Figure 4. Timeline of DVB-T for Hungary

At the moment, there are three available multiplexes for the simulcast period. Basically, pay TV will not be available on the first multiplexes due to the scant capacity of the HD service. It will only be available after the launch of the fourth multiplex. However, two news channels are available as pay TV channels from the beginning.

2.1.5. Costs and benefits analysis related issues

The cable television service is a popular reception mode in Hungary, but the market share of the terrestrial is nevertheless roughly constant. It should be mentioned that market share of DTH service is bound to increase in the next years due to the new DTH market player.Not too many programmes are available free of charge, due to the legislation. The outmoded Media Act does not allow the nationwide commercial broadcasters - using the analogue terrestrial network - to launch the second or more channels. Other broadcasters do not have the opportunity to become nationwide FTA broadcasters because their market share is small. Cable television providers offer their services mainly in the big cities, in DVB-C standard, and IPTV appeared in the market, but their share is negligible.

Table 2. Platform market share (Hungary)

| Platform | Market player(s) | Market share (%) |

| Terrestrial (analogue) | Antenna Hungária Zrt | 28 |

| Terrestrial (digital) | Antenna Hungária Zrt | Cannot be measured |

| Cable (analogue) | UPC, T-kábel, Fibernet, Digi TV | 59.5 |

| Cable (digital) | UPC, T-kábel | Cannot be measured |

| Satellite (DTH) | UPC, T-kábel, Digi TV | 12.5 |

| IPTV | T-kábel | Cannot be measured |

3. POLAND - MARCH 2009

3.1. Policy and regulatory aspects

The Ministry of Infrastructure published the Strategy for Switchover from Analogue to Digital Broadcasting of Television Programmes in 2005. The Strategy made allowances for all circumstances at that time and specified the best proposal. After the RRC06, the Strategy was not renewed and accepted by the government until now!

The same problem, as in Poland, exists in other countries - the validity of the present analogue broadcasters’ licenses is beyond the deadline for the analogue switch off. The challenge for the digital television is to become attractive and offer new content and new services at the same time.

Regulatory priorities are: to ensure media pluralism and multi-pluralism, protection of the national culture and language, to increase access for the public to regional or local content, and extension of the broadcasting services.

The Ministry and Office of Electronic Communications want to support the future-proof solution, they would like to HDTV and interactive services to be available from the beginning. Nonetheless, HD content might not initially be on the second multiplex. MPEG 4 AVC will be the coding system, due to the circumstances (a lot of analogue channels will have to be moved to the DVB-T platform).

The first step seems to be difficult, since all existing analogue terrestrial broadcasters, both commercial and public, have to be placed on one multiplex. One potential problem is the capacity of the multiplex, and the authorities have to solve that. Another problem to be addressed is who will operate this multiplex. In Poland, the broadcasters established the Polish Television Operator to operate this multiplex. The Polish Television Operator will have to choose a transmitter provider.

3.1.1. Licensing /authorization schemes

Holders of broadcasting licenses and frequency reservations (spectrum rights) are entitled to transmit and retransmit radio and television programme services in Poland.

Broadcasting license which is required for programme service transmission is awarded by the Chairman of the National Broadcasting Council in agreement with the President of the Office of Electronic Communications (UKE). The broadcasting license specifies in particular:

- identity of the broadcaster and his place,

- business activity covered by the broadcasting license,

- programme service transmitting method (terrestrial diffusion, satellite distribution and cable system)

- transmission conditions of the programme service/channel (in particular the frequency, as well as the power and location of transmitters intended for emission of the programme service).

Frequency reservation, which is required for terrestrial transmission of programme service (both commercial and public broadcasters), is granted by the President of the Office of Electronic Communications in agreement with chairman of the National Broadcasting Council.

In addition to the frequency license, it is required to use a transmitter by broadcasters or transmission network owners. The frequency license is issued by the president of the Office of Electronic Communications.

Registration is required for programme services which are retransmitted in cable networks. This requirement does not apply to the retransmission of the national public radio and television services and other programme services of domestic broadcasters receivable within the coverage area by means of receivers used by general public. The Chairman of the National Council is the registering authority.

Receiving the right to operate the DVB-T and DVB-H will be different in the upcoming years. First of all, it has to be made possible for all existing analogue TV programmes to be on the DVB-T. The launch of the first one is planned for this year. The current analogue license will be converted to digital by modification and sometimes issuing new license.

The second one will be available as of next year and the right will be granted through a beauty contest. At the moment it has not been defined what content will be available and in which format.

The transition period multiplex structures are given in Tables 3. and 4.

Table 3. Multiplex 1 (UHF)

| Public broadcaster | Commercial broadcasters | |||||

| TVP1 | TVP2 | TVP3 | POLSAT | TVN | TV4 | PULS |

Table 4. Multiplex 2 (UHF)

| Public broadcaster | Commercial broadcasters | |||||

| 7 SD | or | 4 SD | + | 1 HD | channels | |

All remaining multiplexes will be available after the analogue switch-off:

·Multiplex 1(UHF) will belong to the existing commercial broadcasters (FTA)

·Multiplexes 2,3,4 (UHF) will belong to the commercial broadcasters (FTA, partly Pay TV)

·Multiplex 5 (UHF) will belong to the public broadcaster (FTA)

·Multiplex 6 (UHF) will belong to the DVB-H network

·Multiplex 7 (UHF) is for the digital dividend

3.1.2. Applicable standards

DTT is based on DVB-T standards. DVB-T2 standard, published last year, enables 30 to 50 percent bitrate increase, as compared to the first generation standards. Between 2012 and 2020, when new multiplexes become available, DVB-T2 can be introduced. Mobile TV will be based on DVB-H standards.

The MPEG-4 (AVC/H.264) Audio Musicam and/or Dolby Digital Plus (E-AC3) standard may facilitate the fast switchover, considering the circumstances. The disadvantage of this solution is the price of the set top box, yet it decreases year by year. On the other hand, it will support the initiation of the high resolution High Definition Television (HDTV) after the analogue switch-off. The trial, which was launched at Rzeószv, is based on the MPEG-2 standard.

3.1.3. Broadcasting network structure (ownership of multiplex, transmission network)

The Broadcasting Act, which was accepted at the end of 1992, determinates the rules for television services. The present situation:

Figure 5. Network structure

The main broadcaster is TP Emitel. The main owner is France Telecom.

| Name of broadcasters | Coverage | Type | Channels (Terrestrial) | Remarks | Coverage Population % | Coverage Area % |

| TVP | National | Public | TVP1, TVP2, TVP3 | TVP 3 is a regional channel | TVP1 97.6% TVP2 97.6 % TVP3 72.1 % | TVP1 95.8 % TVP2 93.8 % TVP3 55.3 % |

| Polsat | National | Commercial | Polsat | | 81.1 % | 64.6 % |

| TVN | Local, subregional | Commercial | TVN | | 43.1 % | 18.5 % |

| TV4 | Local, subregional | Commercial | TV4 | | 25.1 % | 11.9 % |

| Puls | Local, subregional | Commercial | Puls | | 24.8 % | 11.8 % |

Dates of the ending license for analogue broadcaster are in 2014, 2015 and 2016.

Table 6. Broadcast provider

| Name of broadcast provider | Main owners | Infrastructure | Transition to DTTV |

| TP Emitel | 100% Telekomunikacja Polska S.A. (France Telecom) | The company has the largest infrastructure (based on Stockholm 1961 plan) | DVB-T trial from 2001 together with TVP S.A, TVN, Polsat) |

| PSN | 100 % TDF | | |

| Info-TV-FM | | Few own station | |

| RSTV | | | |

3.1.4. Strategies and process of transition to DTTV

Timeline for introduction of DVB-T:

Figure 6. DVB-T timeline for Poland

At the moment there are two available multiplexes for the simulcast period. 7 SD programs are planned to be in the first multiplex, and the second MUX is used both for SD or HD services during the transition period. Pay TV will not be available on the first multiplexes due to the scant capacity of the HD service. It will only be available from the launch of the third multiplex (data from the middle of 2008).

The first multiplex will be available for the present analogue broadcasters at the end of this year, without any call for tender or auction. It is necessary to reach some kind of agreement with the present broadcasters, so that they support the digitalization and become key players while their analogue licenses remain valid.

3.1.5. Costs and benefits analysis related issues

Analogue terrestrial broadcasting is a popular reception mode in Poland, but the market share of DTH increases each year.Relatively many programmes are available, thanks to the broadcasters and they can be reached free of charge (FTA). The cable television providers offer their services in DVB-C standard mainly in the big cities, and IPTV appeared on the market, but their share is negligible.

Table 7. Platform market share (Poland)

| Platform | Market player(s) | Market share (%) |

| Terrestrial (analogue) | TP Emitel, PSN, Info-TV-FM, RSTV | 30.7 |

| Terrestrial (digital) | | Cannot be measured (trial) |

| Cable (analogue) | UPC, Aster, Multimedia Polska, Netia TP | 30.7 |

| Cable (digital) | | Cannot be measured |

| Satellite (DTH) | Cyfra +, Cyfrowy Polsat | 38.9 |

| IPTV | 0.5 |

Author

Péter Vári received his technical diploma degree in telecommunications from the Technical University of Budapest in 1994, after that he graduated from the Economic University of Budapest in 2001 and the University of Eötvös Lóránd, (Faculty of Laws) in 2003. He is a PhD student at the University of Pécs, his specialization is digital television. Mr Vári currently holds the position of digital switchover project manager, at Antenna Hungária. Previously, he worked as Senior Government Advisor at Prime Minister’s Office. He was responsible for the Project on Digital Switchover (National Strategy on Digital Switchover, Act on Digital Switchover, other regulatory implications). He participated in the Project on National Audiovisual Media Strategy (National Strategy on Audiovisual Media), drafting a new proposal on the Hungarian Media Act.